Payday loans are known for their speed and short-term nature, but many borrowers don’t actually want to keep the debt for the full loan term. The idea of paying a loan off early seems sensible—after all, it should mean less interest. But can payday loans in the UK really be repaid early without additional fees, or is there a catch?

Having looked into the terms of different lenders and spoken with borrowers who’ve gone through this process, I’ve learned that early repayment is often possible, but the rules vary depending on the lender. Understanding how it works can help you avoid surprises and even save money.

Early Repayment Rights in the UK

In the UK, payday loans fall under consumer credit regulations, which provide certain protections for borrowers. One of these protections is the right to repay a loan early. In most cases, this means you can clear your balance before the agreed repayment date, potentially saving money on interest.

The Financial Conduct Authority (FCA), which regulates payday lending, requires lenders to allow early repayment. This means borrowers should not be locked into paying more interest than necessary. However, the exact savings depend on how the lender calculates interest and whether they charge any administrative fees.

Many providers of uk payday loans make it clear in their terms that early repayment is allowed. Some even encourage it as part of their responsible lending policies. But not all lenders are equally transparent, so checking the fine print is important before committing.

Do Lenders Charge Extra for Early Repayment?

One concern many borrowers have is whether lenders add extra fees if you repay early. In traditional loans, some banks apply what’s called an “early repayment charge” to cover lost interest. With payday loans, this is much less common, largely because these loans are short-term and high-interest by design.

In practice, most UK payday loan lenders do not penalise early repayment. Instead, they recalculate your balance based on how many days the loan has been active, then charge interest accordingly. If you borrowed £300 for 30 days but repay in 10 days, you’d usually only pay interest for those 10 days, not the full month.

Still, it’s worth noting that some lenders might include small administrative fees or limit how early you can repay. Always review the terms and conditions carefully so you know what to expect.

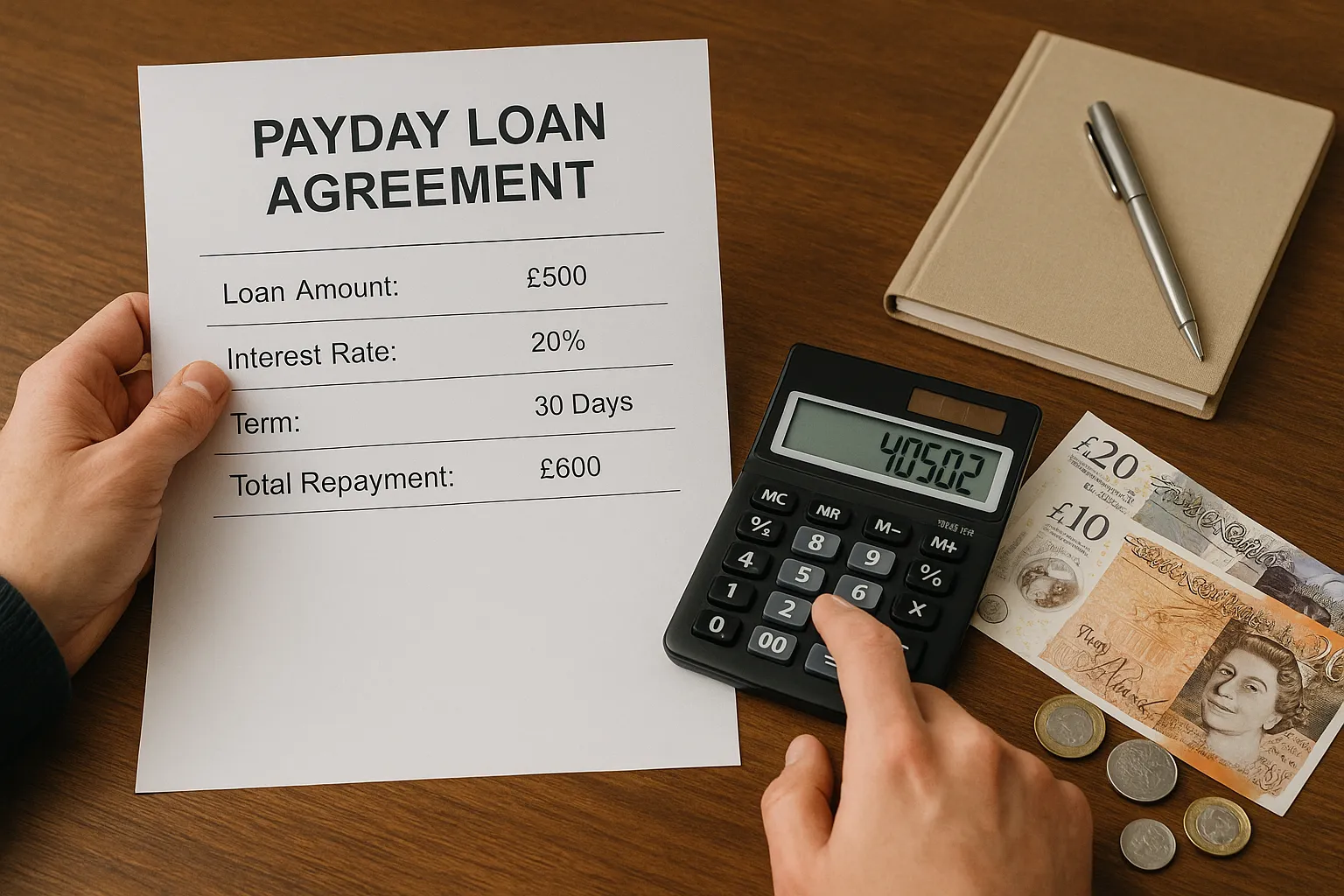

Real-World Example of Early Repayment

Let’s say you borrow £200 with a payday loan at a cost of £20 per £100 borrowed over 30 days. Normally, you’d repay £240 at the end of the month. If you repay in just 10 days, the lender may only charge you around £8 in interest instead of the full £40. Your total repayment would then be about £208.

This difference can be significant, especially if you frequently use payday loans. Borrowers who pay early often save a noticeable amount in reduced interest, which is why knowing your rights is so valuable.

How to Repay Early

If you’re considering early repayment, the process is usually straightforward. Most lenders allow you to log into your online account, view your outstanding balance, and make a payment through debit card or bank transfer. Some lenders also allow early repayment by phone.

It’s best to contact the lender in advance and confirm the final settlement figure. That way, you know exactly how much you need to pay, and there are no surprises.

Benefits of Early Repayment

Repaying a payday loan early doesn’t just save money on interest—it can also help protect your credit record. Payday loans, even when used responsibly, are often viewed negatively by future lenders. Reducing the length of time the loan is active may improve how your borrowing looks on your credit file.

Another benefit is peace of mind. Many borrowers feel relief when clearing the debt sooner, as it reduces financial stress and avoids the temptation to roll over loans into future months.

Borrower Experiences

In my research, I’ve come across borrowers who were pleasantly surprised by how much they saved by paying early. Some even reported that lenders encouraged them to do so as part of good financial management. However, others shared stories of confusion when the repayment calculation wasn’t clearly explained.

This shows why transparency matters. While early repayment is generally beneficial, not all lenders communicate it well. That’s why it’s important to choose reputable providers who are upfront about how repayments are handled.

Responsible Borrowing and Final Thoughts

So, can payday loans in the UK be repaid early without fees? In most cases, yes. Borrowers have the legal right to repay early, and most lenders do not impose penalties. Instead, you’ll usually pay interest only for the period the loan is outstanding, saving money compared to waiting until the full term ends.

The key is to understand the terms of your specific loan and confirm the settlement figure with your lender before making an early payment. Early repayment can be a smart move, both financially and for peace of mind, but only if you’re clear on how the calculation works.

Ultimately, payday loans should always be approached with caution, whether you plan to repay early or on time. They can be a useful safety net in emergencies, but they’re no substitute for long-term financial planning. By staying informed and using your rights wisely, you can keep borrowing costs as low as possible.